By Sean McDevitt, Director of CEM Product Marketing at Everbridge

As climate change continues to pose significant risks to organizations worldwide, it’s not only the physical threats of extreme weather events that companies must navigate but also an evolving landscape of regulatory requirements. The U.S. Securities and Exchange Commission (SEC) has introduced climate disclosure rules requiring publicly traded companies to provide detailed reporting on how climate change affects their business, both in terms of actual and potential impacts. This regulatory shift underscores the need for a robust, real-time response and risk management system like Everbridge Critical Event Management (CEM), designed to help organizations assess, act upon, and analyze climate-related risks efficiently and effectively.

Understanding the risk and regulatory landscape

The introduction of SEC climate disclosure rules marks a significant step towards transparency and accountability in how organizations address climate change. These rules compel organizations to evaluate not just the immediate physical risks posed by climate events but also the broader implications on their operations, financial performance, and strategic outlook. Everbridge CEM provides an essential toolset for navigating both these dimensions, offering advanced capabilities to assess climate risks and the means to report on these risks in compliance with regulatory requirements.

Real-time assessment and compliance alerts

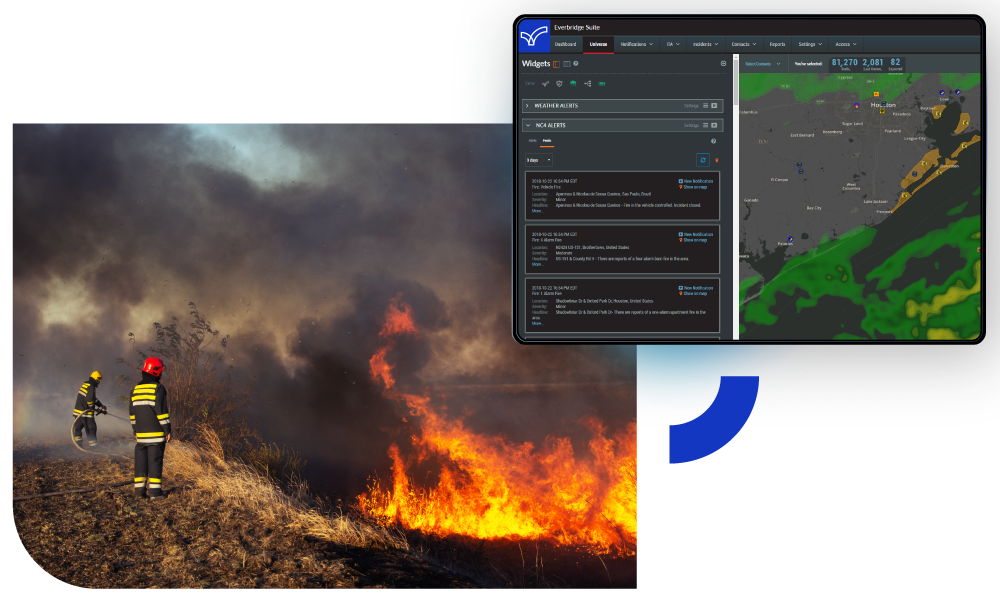

Everbridge CEM’s real-time monitoring and alert system is pivotal for organizations striving to stay ahead of both climate events and regulatory changes. By offering tailored alerts on climate-related risks and regulatory updates, Everbridge ensures that organizations can respond promptly to physical threats while also keeping pace with compliance requirements, integrating this data with actionable insights for both immediate response and long-term strategy adjustments.

Actionable insights for immediate response and reporting

Swift action in the face of climate events is critical, but so is the ability to document and report these actions in alignment with SEC disclosures. Everbridge CEM facilitates this dual need by enabling organizations to not only coordinate efficient response efforts but also track and document these actions in a manner that aligns with disclosure requirements. This capability ensures that companies can provide transparent reporting on their risk management processes and outcomes, an essential component of compliance.

Enhancing coordination for compliance

The coordination capabilities of Everbridge CEM extend beyond managing physical climate events to facilitating compliance with regulatory requirements. By enabling seamless communication and information sharing across departments, Everbridge helps ensure that all aspects of climate risk management, from initial risk assessment to final reporting, are conducted in a comprehensive and compliant manner. This holistic approach is vital for meeting SEC requirements and for fostering investor confidence.

Analyzing and learning from events for regulatory reporting

Post-event analysis is crucial not just for internal improvement but also for regulatory compliance. Everbridge CEM’s comprehensive reporting and analysis tools allow organizations to meticulously review their handling of climate events, providing the data needed for SEC climate disclosures. This includes detailing the efficacy of response measures, the financial implications of climate events, and the steps taken to mitigate future risks.

Continuous improvement through regulatory insight

The analytics capabilities of Everbridge CEM offer a pathway for continuous improvement, not only in risk management practices but also in compliance and reporting. By utilizing data from past events, organizations can refine their strategies to meet both operational and regulatory needs more effectively. This ongoing cycle of analysis and adaptation is key to thriving in a regulatory environment focused on transparency and accountability in climate risk management.

The SEC climate disclosure rules represent a paradigm shift in how organizations approach climate risk management, placing a premium on transparency, accountability, and strategic foresight. Everbridge Critical Event Management emerges as a comprehensive solution in this new landscape, enabling organizations to not only manage the physical risks of climate change effectively but also navigate the complexities of regulatory compliance. With Everbridge CEM, organizations have a powerful ally in their efforts to protect their operations, meet investor and regulatory expectations, and contribute to a sustainable future.