The value of business continuity as part of your end-to-end critical event management strategy

In today’s volatile business environment, organizations face a mountain of unpredictable challenges—from natural disasters to cyber-attacks, supply chain disruptions to IT outages—that can impact the safety of employees, operational uptime, or customer satisfaction and loyalty. The ability to navigate these critical events hinges on one key factor: resilience. Here, we explore why business continuity is essential to your end-to-end critical event management strategy and how comprehensive planning and preparedness can redefine organizational resilience.

Why business continuity is vital today

Effective business continuity solutions are no longer optional; they are critical. The landscape we operate in is fraught with unpredictability. The frequency and severity of disruptions have escalated, making robust preparation and rapid response mechanisms a necessity. Furthermore, regulatory compliance demands have tightened, with many industries now subject to stringent regulations that require detailed continuity and disaster recovery plans.

Customer trust and loyalty also hinge on the reliability of an organization’s continuity plans. During crises, the ability to maintain service delivery can make the difference between retaining and losing valuable customers. From a financial perspective, minimizing downtime and ensuring that operations continue smoothly during disruptions can stave off significant financial losses, preserving your organization’s stability and reputation.

The comprehensive approach of an end-to-end solution

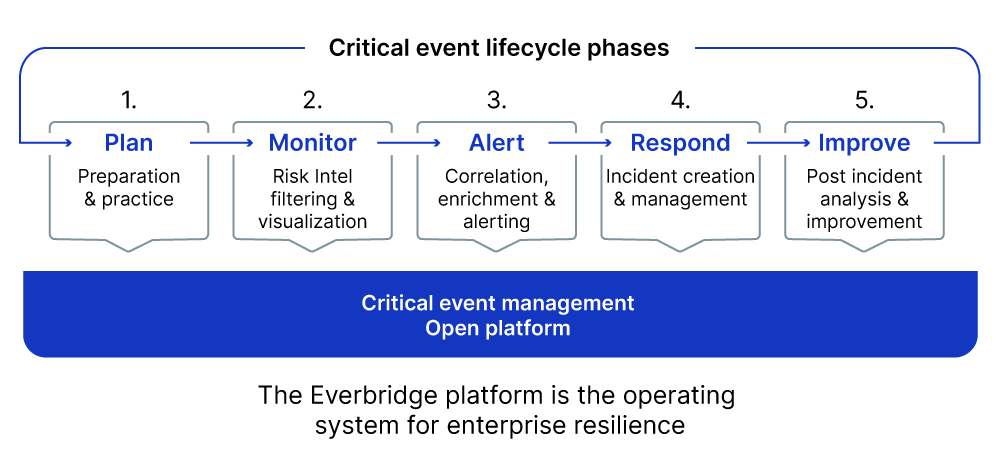

Organizational resilience requires a robust end-to-end critical event management strategy that incorporates business continuity. The lifecycle of managing a critical event is built on five foundational pillars: Plan, Monitor, Alert, Respond, and Improve. These pillars ensure that organizations are not only prepared for any event but can also respond effectively, recover swiftly, and continuously enhance their resilience strategies.

The Everbridge platform

The key capabilities of an effective business continuity solution include the ability to develop detailed, tailored plans that address specific organizational needs. Conducting thorough business impact analyses is crucial for identifying and prioritizing critical business processes and resources. Equally important is fostering enterprise-wide collaboration, enabling teams to work together seamlessly across the organization.

Regular testing and refinement of continuity plans are essential to ensure their effectiveness. Meeting industry-specific compliance requirements effortlessly is another critical capability, allowing organizations to navigate regulatory landscapes with confidence.

The value of a comprehensive solution

An all-in-one end-to-end platform is designed to ensure that organizations can anticipate, mitigate, respond to, and recover from critical events. Such a platform integrates business continuity planning with critical event management, creating a cohesive and unified approach. Enhanced communication capabilities accelerate the dissemination of critical information and facilitate collaboration across the enterprise, significantly reducing response times during crises.

Streamlined onboarding processes enable new users to quickly and fully leverage the platform’s capabilities, ensuring that the organization can benefit from the solution’s full potential from the outset. Minimizing communication errors during crises enhances the accuracy and reliability of information, which is crucial for effective incident management.

Continuous improvement is a fundamental aspect of a comprehensive solution. By using real-time data and feedback, organizations can refine and enhance their response strategies, ensuring that they are always prepared for the next challenge

Conclusion

In the face of today’s complex threat landscape, having business continuity as part of your end-to-end enterprise resilience strategy is not just beneficial—it’s essential. A comprehensive end-to-end solution provides the resilience organizations need to stay prepared and responsive. By effectively planning, anticipating, and responding to critical events, organizations can not only survive disruptions but emerge stronger.

Achieve total enterprise resilience with a robust business continuity solution—keeping your people safe and your operations running, no matter what challenges arise.

To learn more or to request a demo of how Everbridge 360 – now with Infinite Blue – can help you achieve total enterprise resilience…..

This is where Physical Security Information Management (PSIM) software becomes crucial. As security challenges become more multifaceted and frequent, PSIM has emerged as a popular choice for organizations seeking a holistic and integrated approach to security management. PSIM software is designed to offer an integrated and comprehensive view of security operations, enhancing situational awareness and improving response coordination. Choosing the right PSIM vendor is therefore not just about purchasing software, but investing in a system that can evolve with your security needs.

Threats and disruptions of all types are increasing, a higher frequency equates to a bigger impact on populations and businesses

This eBook looks at the challenges faced by municipalities as they strive to respond promptly and effectively to issues that impact residents’ daily lives.

The 2024 Best in Resilience Study offers a comprehensive summary of global risks and showcases how top-performing Best in Resilience certified organizations are managing and mitigating threats to keep their people safe, and operations running.

A practical guide for risk professionals to manage the multiple dimensions of operational resilience.

Everbridge provides PSCU with a flexible, easy-to-use solution that can be quickly scaled depending on incident and event type. PSCU utilizes the system to keep employees safe and informed during weather related incidents, as well as routine events such as fire drills.